Quick and simple insurance

It was so simple to get insurance. Clear and easy guidance insured within minutes which allowed peace of mind when picking up new car on a weekend.

Yesterday

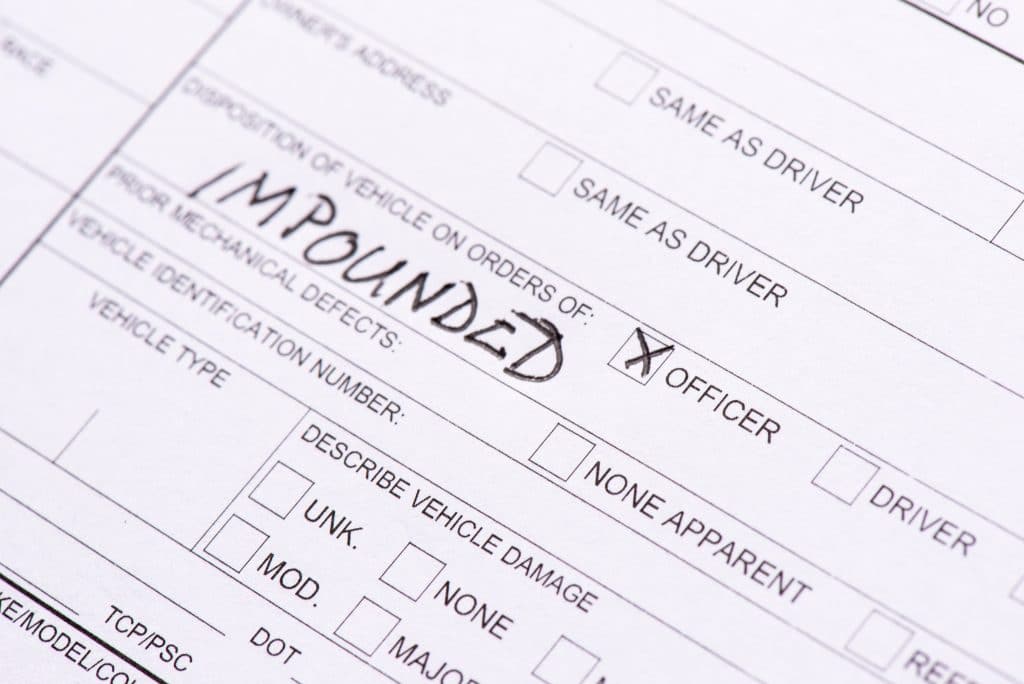

The last thing anyone needs is their van impounded, particularly if you rely on it to keep your business running. Whatever the reason is that your van has been impounded, you need to turn your mind to getting it released as quickly as possible.

There are a few things you’ll need to do in order to facilitate the release of your van, and one of those is making sure the vehicle has insurance cover. Without it, the authorities will refuse to release your vehicle, even if you have everything else in place.

However, getting insurance in place for an impounded vehicle can be tricky. Many insurers just won’t provide insurance for a van that’s in an impound. Thankfully, all is not lost. With specialist impound insurance from Tempcover, you can get cover that’ll give you exactly what you need to get your vehicle back.

This kind of policy is specially designed to let you retrieve your van quickly and without any hassle. The minimum length of cover that National Police Protocol and other authorities will expect to see is 30 days of insurance, so that’s exactly what you’ll get from van impound insurance.

If you need to get your van back as a matter of urgency, you’ll be glad to know that you can have cover in place almost instantly, and we’ve made arranging it as straightforward as possible.

There are many reasons why the authorities may have decided to impound your van, and the most common include:

The are several authorities that have the power to impound you van, including the police, DVLA and the local authority. If you’re listed as the van’s owner, they’ll make efforts to contact you once the van has been taken.

Without specialised impound insurance, your van won’t be going anywhere. You may well have an annual policy already, but there’s every chance that your existing arrangement doesn’t cover for you for impound. Or there’s a chance your van doesn’t have insurance at all – it could well be the reason it was impounded. In either case, you’ll need to get something in place quickly.

You could pay to take out an annual impound insurance policy, but this could be very costly indeed, at a time when you’re already having to pay out other charges just to get your vehicle back. That’s why a temporary policy can make a lot of sense.

But you can’t just take out standard temporary cover. That’s because the time limit on one of those policies is set at 28 days, whereas you’ll need to have 30 days insurance to get your van back. Fortunately, there are temporary impound insurance policies that provide exactly what you need.

Arranging 30 days of insurance isn’t the only thing you’ll required to provide or arrange in order to get your van back. You’ll also need:

You don’t have long to get your vehicle out if it’s been impounded, so you’ll need to get everything in place as quick as you can. You have just 14 days to reclaim the van, and the longer you leave it, the more you’ll have to pay. Most pounds charge a £20 a day storage fee, so the costs can start to mount if you don’t act fast.

If you don’t collect your van, and fail to present the documentation you need within 14 days, the vehicle can be disposed of.

It’s hard to say how much it will end up costing you to get your van out of impound, as it hinges on several factors. What you’re charged will vary depending on the authority that has collected your vehicle, and how long they’ve ended up holding it for. You’ll also need to pay a set release fee before you can have it back, as well a pay your road tax if it’s overdue on the vehicle.

If your van’s been impounded, the last thing you need is for your insurance to take days to arrange, and even longer to kick in. That’s why we’ve made getting impound van insurance as quick and straightforward as possible.

To start, you’ll just need to provide some key details about yourself, such as where you live and what you do for a living. We’ll also need to know all about your van, as well as why it’s been impounded.

With this information, we do all we can to bring you some quotes in minutes. From there, you simply select whatever suits you best and pay up. You can have your policy start right away, and all the documentation is emailed to you instantly, so you can focus on getting your van back fast.

Getting short term impounded van insurance depends on a number of factors including your age, vehicle, driving history among others. We can, however, confirm that to be eligible for impounded van insurance you must meet at least the following criteria:

We’re experts at finding the right temporary van insurance policies for van users. Whether it’s specialist temporary business van insurance or young driver van insurance to get new recruits to your business up and running, we can help. We also offer one day van insurance for those unexpected jobs.

We also currently hold an ‘Excellent’ rating on Trustpilot with over 30,000 reveiws.

After you’ve bought your policy, your documents will be emailed to you instantly so there’s no waiting around.

We use essential cookies to make our website work. We'd also like to use non-essential cookies to help us improve our website by collecting and analysing information on how you use our website and for advertising purposes.

You can agree to accept all cookies by clicking 'Accept all cookies' or you can change your preferences by clicking 'Manage Cookies' below. For more information about the cookies we use, see our cookies policy

We use essential cookies which are necessary to ensure our website works correctly.

We'd like to set non-essential analytics and marketing cookies that help us provide a better experience to our users. These help us improve our website and marketing by collecting and reporting information on the campaigns and web pages you interact with. It also helps us to target our marketing campaigns to people who are most likely to be interested in our services.

We'd also like to set a non-essential cookie which enables us to playback your journey on our website to assist with troubleshooting and to help us improve our website based on the behaviour of our customers.