Is legal cover necessary with your car insurance?

There are a lot of misunderstandings when it comes to legal cover and car insurance. If you have car insurance, you may not even understand why you need additional legal cover, but in the event of an accident, it could safeguard you against an array of extra costs and help you to claim back expenses. In this guide, we’ll look at all the key terms, and explain what legal cover car insurance is, how it works, and why legal protection and assistance is important.

What is legal cover car insurance?

Legal cover car insurance was created to prevent motorists from suffering financial losses if they are involved in an accident that wasn’t their fault, by covering costs such as loss of earnings, policy excesses and the expense of making a personal injury compensation claim. Your car insurance policy alone can’t help you claim these back, which means if you don’t have legal cover, you will have to hire a solicitor to try and claim these costs back for you. This can be expensive, and you might not get anything back. You can get legal cover as an addition to your car insurance, but it doesn’t always come as standard, so if you want legal assistance or legal protection as part of your car insurance policy, you should always ask about it upfront. The Office of National Statistics estimates that more than 25 millions households in the UK have legal cover.

What is legal assistance car insurance?

Legal assistance or protection on car insurance is essentially legal cover. Alongside protecting you against losses from accidents that weren’t your fault, assistance also helps to cover legal costs if you’re facing prosecution for a motoring offence which you are disputing. This would also cover legal costs relating to consumer disputes you may have after buying or selling a car, or issues you may have with the garage about bad servicing or shoddy repair work. Some insurance companies also offer 24/7 legal advice as part of their legal cover package.

Why do you need legal cover?

Legal costs can be huge if you’re involved in an accident. Therefore, the main reason why you might need legal cover is to safeguard you against financial losses if you’re involved in an accident that isn’t your fault. And as we explained above, some policies will also cover legal costs for accidents or motoring offences which you have been blamed for, as well as other disputes. Buying legal cover with your motor insurance is effectively buying peace of mind.

What does legal cover car insurance include?

This will vary between insurers, but generally speaking, legal cover car insurance can include the following:

- Uninsured Loss Recovery – this is the recovery of any costs incurred as a result of an accident that wasn’t your fault such as physiotherapy bills or medical treatment if you’ve been injured. Legal cover will help you to recover these kinds of uninsured losses, which could also include loss of earnings or personal injury compensation.

- Legal defence – to cover the cost of legal expenses, if you receive a summons for an alleged motoring offence involving your vehicle.

- Travel costs – cover for travel costs to legal proceedings where the accident happened. Depending on the insurer this can sometimes include anywhere in Europe.

- Consumer disputes – cover to help you pursue breach of an agreement following the purchase, selling, service or repair of a motor vehicle.

- Legal protection/assistance/advice – your insurance company will hire a specialist solicitor to act on your behalf for any claim. Some insurance companies also provide 24/7 legal assistance as part of their legal cover. This advice can also cover personal legal matters such as Wills, Probate, Employment, Family and Conveyancing matters.

- Recover your excess – legal cover can be used to recover any excess you have to pay as a result of a crash in which you were not at fault. This may be done as part of Uninsured Loss Recovery.

- Additional drivers/family members – you can usually add family members to your policy if they live at the same address.

- Passengers – legal cover will protect and cover any passengers in your car for uninsured losses if you are involved in an accident.

- Accidents abroad – your policy will cover you abroad in the result of an accident or motoring offence although be sure to check with your insurer which countries are included.

The exact details of cover will be different between insurance companies, so be sure to shop around, compare prices and look at what different packages offer. The list above is indicative, but packages can vary. It’s always best to compare deals.

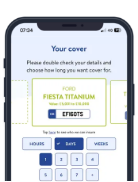

How do I add legal cover to my car insurance?

While some car insurance policies will include legal cover, for many others it is not a standard feature and will be classed as an additional extra. It will need to be discussed and set up directly with your insurer, either when you first take out the policy, or later. Usually, you can add legal cover by agreeing to pay an extra amount each year, although the exact package, and what it covers, can vary between companies and will need to be agreed with the individual insurer.

Only pay for the cover you need

Whenever you’re taking out car insurance, one of the golden rules is to only pay for the amount of cover and length of cover you actually require. There’s no need to pay for expensive annual cover if you only need a car temporarily. Instead, why not consider a cost-effective, flexible and short-term alternative and compare temporary car insurance?

Temporary car insurance is time-limited cover that’s ideal for when you need to borrow a car, pick up a new vehicle or just share a long drive. Whenever you need to use a car that you’re not already insured to drive, temporary cover is the flexible and affordable option.

How does short term car insurance work?

While temporary and annual cover are different products, with short term car insurance you get the same level of comprehensive insurance but for a duration that works for you. It works in the same way your usual insurance does except there are no long term contracts. Once the policy duration you choose is over, it won’t automatically renew, the policy simply expires and that’s it.