Car insurance can be a bit of a minefield, whether you’re a new driver or experienced motorist looking for the best deal. But as a legal requirement to drive in the UK, it’s important to understand what car insurance the best fit for you is.

What are my options when choosing car insurance?

The good thing about car insurance is that you can tailor your policies to fit your lifestyle and budget. Car insurance policies are split into three main categories:

The good thing about car insurance is that you can tailor your policies to fit your lifestyle and budget. Car insurance policies are split into three main categories:

- Third Party

Third party car insurance is the legal minimum you need on your motor before you can drive it in the UK. It essentially means that if you have an accident which causes damage to you, one of your passengers, other drivers, animals or property, then you’ll be covered. But it won’t cover the cost of any damage to your own car. This is typically the cheapest option available.

- Third party, fire and theft

As the name may suggest, this covers everything as described above, but with the addition of covering your car if it’s unfortunately stolen, damaged, or destroyed in a fire.

- Comprehensive

Comprehensive car insurance offers everything included with Third party, and theft insurance, but will also cover the damage to your own car, which isn’t typically included in lesser insurance policies. Whilst all policies will differ, typically comprehensive insurance is the most complete level of car insurance available and will typically give you full financial protection for your car, as well as a personal injury safety net.

What factors will affect my car insurance quote?

The type of car insurance from the choices above will dictate the cost of your policy. The more cover you want, the more it will cost. But there are certain factors regarding your lifestyle which will be considered when costing up your options. Think whether you can alter any of these in order to get a better deal.

- Gender, Age & Marital Status

Car insurance is a numbers game and insurers will take demographic statistics into account when considering how much to quote you. For example, younger drivers are typically more inexperienced and will pay a hefty sum for their youth! But the bonus of getting older is that your premium should drop each year, provided you’ve not had any accidents.

- Your Address

Whether you live in a city or suburb, beside a school, or in a high-crime area, all of these factors will be noted for your insurance. Don’t forget to think about where your car will be kept overnight – a private home garage is ranked safer than a public car park.

- Your Employment

If you’re on the road a lot with work, you’re more likely to be in an accident explaining why delivery drivers may face a higher cost than an office worker, for example.

- What Type of Vehicle You’re Insuring

The likes of sports car are not only bigger targets for car theft, but are also more likely to be included in accidents, due to their increased engine size. If you’re in the market for a more budget-friendly car insurance, consider a smaller city car or family vehicle, which are typically deemed safer and therefore cheaper to insure.

- Your Driving History

Any accidents, tickets, or previous claims on car insurance will influence future car insurance costs. Safer drivers, however, will be entitled to “no claims” bonuses to reward those unblemished driving records, ultimately saving you money the longer you’ve been a safer driver.

- Your Driving Activity

The more miles you expect to drive within a year, the more you’ll pay for the privilege. So consider whether you need your car for just leisure, or for commuting to work as well.

How do I get the best deal on car insurance?

Once you’ve decided which type of cover would best fit your budget, it’s time to shop for the best quote. Cheaper does not always mean better, so first ensure you’ve got the correct type of cover to fit your needs and then it’s time to shop around. Here’s how you may be able to shave some cash off your cost.

- Increase Your Voluntary Excess

If you volunteer to pay towards the cost of any accidents or repairs, your overall premium will be lessened. Play around with the figures to see what amount you’d comfortably be able to contribute in the event of a potential claim.

- Secure Your Car

Did you know that fitting your car with an immobiliser or approved alarm can reduce the cost of your car insurance? Many new cars have these built-in and therefore have lower premiums, but it’s worth a check to save some cash.

- Protect Your No Claims Bonus

Many policies now offer the chance to pay a small sum to protect the “no claims” status you earn from being a safe driver. It’s a worthwhile cost, which will help keep your premiums stay low year after year.

Other car insurance options

If you drive or own a vehicle then by law, you must have at least third party motor insurance. If you feel you aren’t getting value for money with your current deal, you may want to look elsewhere for cover. In the meantime, you may want to consider a cheap temporary car insurance alternative while you organise annual insurance.

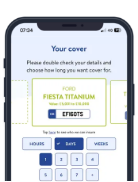

A temporary insurance policy could be a great option if you’re looking for ways to reduce costs. At Tempcover, we provide various types of short term cover, including one month insurance options – ideal for when you need coverage on a short-term basis.

If you’re considering getting temporary cover, you will likely be accepted if you:

- Are aged between 18 and 78 years old

- Are the holder of a UK or EU driving licence

- Have held your licence for at least 6 months (12 months for EU licenses)

- Are looking to insure your car which is valued between £800 and £65,000.