Choosing van insurance can be overwhelming at the best of times. There are so many options out there, but it’s vital to find the cover that meets your requirements and will keep you secure in an emergency.

Thinking about any driver van insurance? Before taking out any policy, it’s important to do your research. Here, you’ll find everything you need to know about any driver van insurance, so you can be on the road in no time.

How does any driver van insurance work?

Any driver van insurance covers a group of people to drive one van. It differs from standard van insurance in that you don’t have to be a named driver on the policy – any unnamed driver can get behind the wheel.

Benefits of any driver van insurance

- Reduces the hassle and cost of adding and removing team members to the policy

- Useful for small, growing businesses that share the use of one van

- Comes in handy for last-minute jobs where the business owner might not be available

- More cost-effective than taking out individual policies

What does any driver van insurance cover?

This entirely depends on the type of policy you choose to take out. Any driver van insurance can be:

- Full comprehensive: this offers the greatest level of protection for your van. It covers damage to your own vehicle, as well as covering for accident, fire, theft, and third-party liability.

- Third party, fire and theft: this type of policy covers you if you cause injury to other drivers. It also covers you for any damage caused by fire or theft.

- Third party only: this type of policy only covers you for damage caused to a driver or passenger in another car, damage to another person’s car or damage to another person’s property

What factors affect any driver van insurance premiums?

There are a variety of factors that could affect your any driver van insurance premiums. These include, but are not limited to:

- Any existing claims or convictions on your license

- Your voluntary excess

- Your level of no claims discount

Are there any restrictions on any driver van insurance?

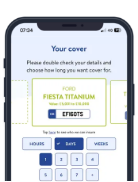

The policy may say ‘any driver’, but this does not mean that just anybody can hit the road in your van. It’s important to double check the fine print for any restrictions on your policy, as failure to do so could result in it being invalidated.

When taking out any driver van insurance, it’s vital to double check any age limits. Many policies of this nature will not cover drivers under the age of 25 or 21.

Many insurers have a condition which requests all drivers of the van to have a clean driver’s license, so it’s vital to check this before hitting the road.

Can i drive another van with any driver van insurance?

No. Unless you have a different policy for a different van, you can only drive the van that’s specified in your cover.

Is any driver van insurance suitable for personal use?

While any driver van insurance is usually aimed at businesses, it can prove useful for private van users too. You might own a van due to hobbies such as fishing or biking, or you may use it to help out friends and family members – whatever the reason, an any driver policy would let you share your driving responsibilities with others. This is especially beneficial in the case of long journeys, as you could split the driving between you and your passenger.

Is there any way to keep costs down?

Any driver van insurance can sometimes be costly due to the insurer not knowing exactly who will be driving the van. Help keep the costs down with the following tips:

- As mentioned previously, many any driver van insurance policies have age restrictions. To keep costs down, only allow older or more experienced drivers to use the van

- When it comes to van insurance, the bigger and heavier the van, the higher the premiums. To keep costs down, buy the smallest, lightest van that suits the needs of you and your business

- It matters where you keep your van when it’s not in use. If it’s stored in a secure depot, for example, your premiums will be cheaper than if it’s parked on the street

What’s the difference between multi-van and any driver van insurance?

Any driver allows more than one person to drive the same van. Multi-van insurance covers one or more people to drive more than one van.

What if i want to insure multiple vehicles?

If you need to insure more than one vehicle, any driver van insurance is not the best option for you. Choose fleet insurance instead. Fleet insurance covers all your vehicles and drivers under one policy.

What if i use my van for a delivery business?

If you use your van for a delivery business, you will need to take out haulage or courier insurance instead.

If you’re looking for a temporary insurance solution, it’s worth considering a temporary van insurance policy. This means that you’ll get the same level on cover but will only pay an insurance premium for the time that you need it for.