Once-upon-a-time, driving a friend’s car or van was as simple as that. In the past, fully comprehensive car insurance policies meant drivers were covered on almost any vehicle with just the owner’s word.

In recent years, things have changed. Insurance providers are coming down on anything that might be considered high risk, and unfortunately for drivers, that includes letting you drive other vehicles without unique insurance. Driving a car or van that isn’t yours isn’t as simple as it used to be, but with the right insurance policy, there’s no reason that you can’t enjoy a little flexibility.

Can i drive a van on my car insurance?

You might be able to drive a van on your car insurance, but whether this is the case will depend on your specific insurance policy. To find out whether you’re covered for driving other cars and vans, it’s best to get in touch with your annual insurance provider.

You can also look at the small print of your policy documents to find out if you’re covered to drive a van that isn’t yours.

What if my insurance is fully comprehensive?

Some fully comprehensive insurance will include an extension which allows the driver to use another car or van under their existing policy. The cover you receive in this way will usually be third-party, so it shouldn’t be relied on for regular use.

It’s important to note that not all fully comprehensive insurance plans include this extension, so you’ll need to check with your insurer or look through your documents carefully to be sure.

The ‘driving other vehicles’ clause

If your car insurance policy has a ‘driving other cars’ or ‘driving other vehicles’ clause within its terms and conditions, you can drive a van that isn’t yours and still be covered by your insurer.

The D.O.V clause is an extension, most often on a fully comprehensive insurance policy, which provides you with cover while driving a vehicle that isn’t owned or registered by you.

This type of insurance is usually third-party only, which means if you’re in an accident, you’ll be covered for damages to the other car or personal injury claims made by the other person involved. The third-party D.O.V clause won’t cover the cost of any damages to the vehicle you’re driving.

The D.O.V clause is designed to be used in emergency situations only and shouldn’t be relied on as suitable insurance for regular use. If you’re planning to drive somebody else’s van, you should consider getting a temporary van insurance policy to ensure you’re covered against any eventuality.

For the extension to be valid, there are some criteria which will need to be met:

- The car does not belong to the driver and has not been hired to them

- The driver has the permission of the owner

- The driver is aged 25 or over

- The driver’s personal policy includes the driving other vehicles extension

- The vehicle is insured

Unfortunately, many drivers believe that if they are over 25 and have fully comprehensive insurance, they are insured to drive any car or van. This is not the case, and the misconception has led to many people being convicted for driving without motor insurance.

Can i drive a car on my van insurance?

The same applies in reverse! If your insurance policy includes the driving other vehicles extension, and both you and the vehicle you want to drive meet all the criteria listed above, you’ll be able to drive a car on your van insurance.

Why choose short term van insurance?

If you’re planning to drive a van that doesn’t belong to you, whether you’re borrowing it to move house, to help shift heavy equipment, or just using it while your car’s off the road, the best way to stay secure is with a short term insurance policy. There are loads of situations that might call for a couple of days’ van insurance, and luckily for drivers, there are plenty of insurers offering this type of cover.

Short term or temporary van insurance is an affordable and flexible choice that works for drivers who are looking to use a van on a short-term basis.

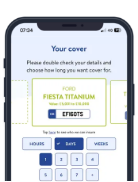

You’ll need to make sure you have the right type of temporary insurance for the type of van you’ll be driving. The make and model, size, age, and security of your temporary van can all have an impact on how much you’ll pay. Your age, location, and driving history can also affect the cost of your temporary insurance.

You’ll be able to choose a temporary van insurance policy from Tempcover if you meet the following criteria:

- You’re aged between 21 and 74 years old

- You hold a UK or EU driving license

- You’re looking to insure a van valued between £800 and £65,000

- You’re looking to insure a van of up to 7.5 tonnes

At Tempcover, we can provide temporary van insurance even if you’re a driver with penalty points.

If you’re driving a van for the first time

If you’re thinking of driving a van on your normal car insurance policy, you might not be used to driving one. If you’re a first-time van driver, you’ll need to make sure you’re comfortable behind the wheel of such a big vehicle.

Vans are bigger and clunkier than cars, which makes them a little harder to manoeuvre. Take it easy, and make sure you’re confident before you try any overtaking or tight bends.

The difficulties in driving a van make it even more important that you choose the right insurance policy and don’t just rely on your usual car insurance, particularly if you’re worried about accidental damages.

If you’re looking for a temporary solution, you might want to consider getting a short term insurance quote. While the temporary and annual cover may be different, a short-term car insurance policy provides you with the same level of insurance for a time that works for you