Motor insurance can be a complex and confusing process for most people but, as the UK’s original InsurTech, Tempcover strives to ensure that it doesn’t have to be. We have completely overhauled our online customer experience across our full offering of entirely digital and transparent short-term vehicle policies that last anywhere between one hour and 28 days. Our customer-centric philosophy permeates into everything that we do – from product design and testing to interactions – Tempcover’s entire online and app-based digital platform is based on direct customer feedback.

Customer-first approach

We invest time in capturing and analysing customer feedback to ensure that we stay abreast of the latest challenges and preferences, and we recognise and reward customer loyalty with discounts and access to exclusive promotions.

Simplified terms & conditions

Through our simplified terms and conditions, there are no long-winded T&Cs – we bring to customers’ attention the most important things and help them engage with it (no box-ticking). They know what they are buying, what’s covered and what’s not. Our straightforward communication of terms and conditions means we receive zero complaints about what is or isn’t covered.

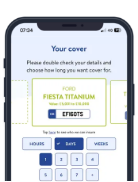

Streamlined user journey

Because our own in-house proprietary technology enables customers to access policy documentation and be comprehensively covered to drive their vehicle within a few minutes, it is recognised as industry-leading as it is dramatically simplifying the process of how insurance is purchased and consumed. A typical annual policy consists of 40 to 50 questions. Our online journey has been streamlined to just seven questions related to registration, policy duration, name, address, driving licence type, driving licence held and email address.

Dedicated app experience

In the next stage of our technological evolution, our app provides the added benefit of giving users the opportunity to create a unique user profile where all policy documentation can be viewed and managed from one central location. Even greater security is guaranteed as the user has the option to set up their own six-digit pin or use their device’s built-in biometric authentication for login. All features are immediately accessible following a one-time set-up to capture all user details. Once registered in the app, it takes customers just two taps for customers to get full cover.

Positive impacts

Our whole user journey is designed to enable our full customer base to gain easy online and app-based access to our service offering and to interact with us seamlessly. We have bucked the industry trend by eliminating complicated underwriting terms and conditions, inflexible ways of working and long lead times when waiting for policy documents. Our super-agile digital offering also brings fully-comprehensive short-term vehicle insurance straight to customers’ fingertips, through a quick and simple user experience that involves a simple policy confirmation process that enables customers to be on cover and driving within a few minutes.

This means that we boast a very high advocacy rate among customers, many of whom are loyal repeat purchasers. This is evidenced in our Trustpilot average rating of 4.6/5 based on over 20,000 reviews, where we are commonly referred to as ‘quick & easy’ – keywords not typically associated with insurance. We are also gaining steady traction on Google Reviews, where we have an average rating of 4.7/5 based on 329 reviews.

Since 2020, our enhanced customer experience has also picked up numerous awards across multiple categories:

2020 UK Broker Awards: Customer Service Award – WINNER

2020 UK Digital Experience Awards: Online User Experience – GOLD

2020 Insurance Times Tech & Innovation Awards: Best Use of Technology for Customer Experience – WINNER

2020 UK Customer Experience Awards: B2B Customer Experience – GOLD

2020 UK Customer Experience Awards: Online Customer Experience – SILVER

2022 UK Business & Innovation Awards: Best Customer Experience – SILVER