Customer loyalty and retention is fundamental to our ongoing success, and this is a category where we have received numerous industry accolades through our data-driven customer relationship management (CRM) programme. As our valued customers know all too well, short-term motor insurance is a needs-based product with rapid, in-the-moment transactions. It is therefore essential for us to remain front-of-mind and to be in the right place at the right time when a customer requires cover at short notice.

We therefore launched a data-driven CRM programme to develop a more intimate knowledge of our customers and their unique needs by building engagement and longer-term relationships, and by recognising loyalty amongst customers who choose to repeat purchase. Our 600,000-strong contact database formed the basis of our target audience and was segmented into seven addressable audience segments based on need and propensity to purchase.

Each targeted audience segment received bespoke content and differing rewards/discount levels depending on previous purchase history and source of business. Our agility enabled us to utilise off-the-shelf email technologies to get a quick start – aligning this into our segmentation and internal analytics capability. SMS communication was introduced and quickly gained measurable traction, now accounting for 70% of CRM sales, which is an industry-leading achievement.

The final stage of our programme was to build our own proprietary discount tool that targets individual segments within predefined customer engagement campaigns – connecting data across our marketing and ‘quote-and-buy’ platforms. This enabled greater personalisation and control which in turn allowed us to actively test price sensitivity to enable discount optimisation.

Our CRM programme now enables us to recognise different need states of one-off usage vs. high repeat multiple usage. For example, a student taking out a one-hour policy to borrow their parent’s car, vs. a trade professional who experiences seasonal peaks and troughs in demand for business and is regularly required to add and remove named temporary drivers of the company van.

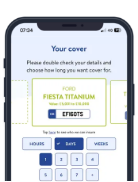

To accommodate that raft of need, customers receive weekly light-touch SMS and email content relating to the various needs and situations where temporary insurance has a role to play that is relevant to them. The content features a straight-through journey to purchase – with the discount already applied to ensure ease and simplicity throughout the entire customer journey.

We reward our repeat customers with preferential offers and make it as easy as possible for them to redeem. To maintain the highest standards of integrity and to differentiate ourselves from traditional retail promotions, we give 100% of the offer to customers and remove all barriers for them so that they can redeem at the checkout – no promo codes or other gimmicks.

Through our CRM programme, we have successfully engaged customers through new communication channels that were previously unavailable and have rewarded our most loyal customers with our most competitive prices. This has enabled us to reduce our reliance on paid channels and to increase revenue from owned channels. Using data-driven marketing, our brand has been utilised to significantly increase repeat purchase rates.

Since 2020, our CRM programme has picked up numerous awards across multiple categories:

2020 British Insurance Awards: Brand Management Award – WINNER

2020 UK Broker Awards: Marketing & Customer Engagement Award – WINNER

2020 UK IT Industry Awards: Best User Engagement Project of the Year – WINNER

2020 Insurance Times Awards: Marketing Campaign of the Year – GOLD

2020 UK Business Awards: Insurance, Banking & Financial Services – SILVER

2021 UK Content Awards: CRM / Email Campaign of the Year – WINNER

2021 Global Digital Excellence Awards: Best Use of CRM – WINNER

2021 Global Content Awards: CRM / Email Campaign of the Year – WINNER