Note – This article was recently featured in the Insurance Post.

Embattled motorists are halting the renewal of their annual vehicle insurance policies and even considering declaring their vehicles SORN in an attempt to save money during a period where their mobility is severely restricted and there is immense uncertainty surrounding their personal finances.

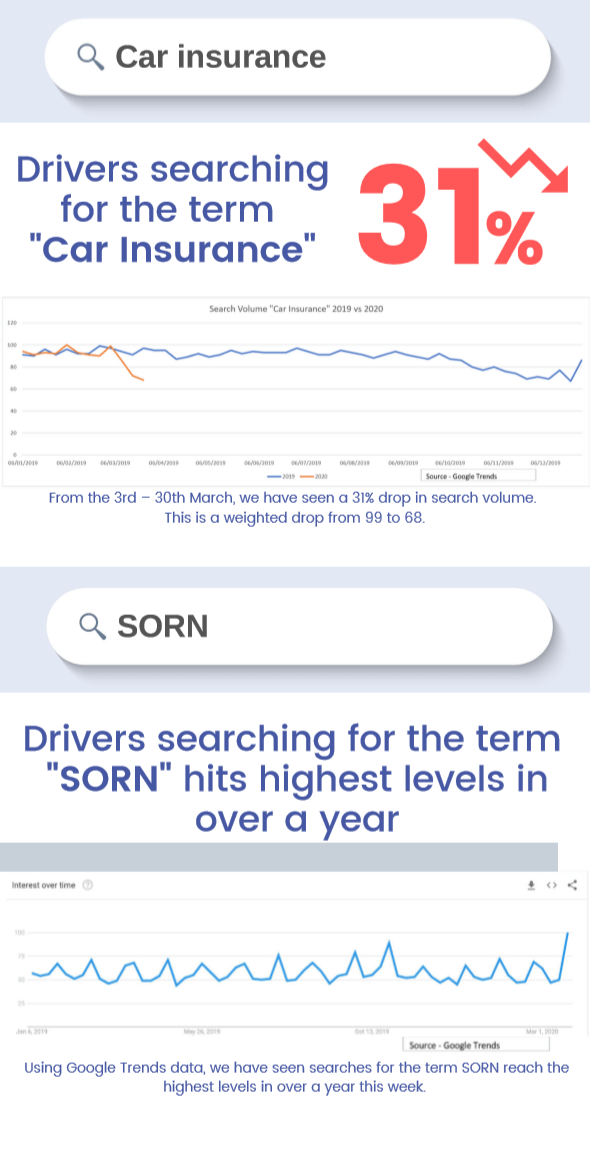

In fact, the latest industry insights reveal a 31% drop in searches for car insurance during the period 3 to 30 March 2020, with a further 38% rise in online users searching for SORN during the period 1 to 28 March 2020.

While it may be tempting to halt all vehicle costs in the short-term, it is important for motorists to be aware that this may have long-term consequences – whether that be financial costs related to policy amendment fees or even prosecution for driving uninsured or untaxed.

Bearing in mind that there are absolutely no additional charges incurred for stopping cover when your annual policy expires – the first step is not to panic and rush into an ill-informed decision like driving uninsured or declaring your vehicle SORN to achieve short-term financial relief.

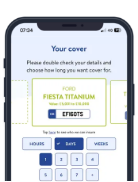

The most suitable yet largely unknown solution during this uncertain situation is temporary vehicle insurance – where motorists only pay for the cover as and when they need it. Provided the vehicle is taxed, affordable cover can be taken for terms as short as just one hour, right up to 28 days, with policies confirmed within two minutes.

This provides peace-of-mind to the millions of UK motorists, who are currently staying home and using their vehicles far more infrequently than usual. As long as the vehicle is parked on private property, with short term insurance they are still legally insured to drive but are not under pressure to commit to an annual policy. If the vehicle is stored elsewhere, continuous cover needs to be maintained.

And this is now more important than ever before, as we are restricted to all but essential travel, and the safest means of transport right now is a private vehicle, as it greatly minimises the risk of cross-contamination by ensuring that social distancing guidelines are upheld.

It also serves as a valuable means of assisting vulnerable people who are unable to access basic supplies on their own. But even in this scenario, it is strongly advisable to minimise trips and to travel alone or only with direct members of your household, while maintaining the two-metre rule if you are dropping off essential supplies for those in need.

As our private vehicles are the safest and most suitable means of transport in these times of immense uncertainty, it is important that we utilise them sensibly and responsibly. Although making a financial commitment to a vehicle during a time of economic upheaval may seem daunting, it’s important to note that temporary vehicle insurance can greatly ease short-term financial pressure, as motorists can insure their short and infrequent road journeys now, and look to renew their annual policy once they have a better idea of their situation when things return to ‘normal’.

Notes

- Insights are based on Google Trends weighted data, accurate as of Monday 30 March 2020

- 31% drop in car insurance searches represents a weighted drop in ‘car insurance’ search volume from 99 to 68

- 38% rise in SORN searches represents a weighted rise in ‘SORN’ search volume from 62 to 100

- 1-hour vehicle insurance policies start from £8.99