According to research by Auto Express, failing to disclose basic modifications to your vehicle – including paint protection products, new alloy wheels and even stickers or decals – can void an insurance policy in the event of an incident.

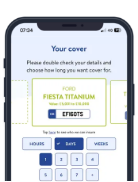

The research conducted in tandem with Ageas insurance and the British Insurance Brokers Association (BIBA), looked at a range of quotations for a basic 123bhp Ford Fiesta insured by a 37-year old male in Southern England.

Modding that mounts

While a base-level factory Fiesta would cost as little as £467 to insure for the year, performance upgrades like an additional turbo charger or a Nitrous injection kit, can increase premiums by over 177%. Taking the cheapest available cover to £1,296.

Other typical “modding” features like a chipping your vehicle management system, upgrading the suspension or adding a roof spoiler, can boost the premium by nearly 20% to a shade under £555.

According to Hugo Griffiths, Auto Express’s Consumer Editor, “while some additions to your car are obvious candidates for telling your insurer about, many motorists will be surprised by the strict definition of modification, and how even a sticker in the back window could void your policy.”

Adding performance badges can add nearly 8% to the premium, while decorative stickers or decals can boost premiums by 16% to £541. Auto Express suggest that, in the case of stickers, showing your allegiance to a sports team or a political viewpoint may raise the threat of vandalism to the vehicle.

Perhaps surprisingly, an aftermarket sat-nav can add an additional 11% to the premium – presumably increasing the likelihood that someone will break into the car to steal movable components.

Griffiths said: “Failing to declare something as humble as paint protection film or different alloy wheels could void a policy entirely, potentially costing thousands in the event of an incident, and even putting motorists at risk of a £300 fine and 6 penalty points.”

Given these politically charged times, perhaps its best to keep your opinions and controversial messages to yourself. Either that, or be prepared to share them with your insurer.