It’s no secret, insurance has a bad reputation for being complex and confusing to most customers, and car insurance is no exception. In this article, we offer you some top tips on how to get the best value motor car insurance, taking into account three different scenarios.

1. Annual policy renewal

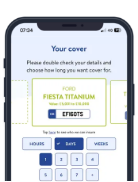

Most industry experts agree that brand loyalty can prove to be costly, so never be content with simply auto-renewing your annual policy. It’s important to shop around for the best deals using price comparison sites to find the policy best suited to you. Also bear in mind that there are absolutely no additional charges incurred for stopping cover when your annual policy expires. This is where temporary insurance offers real value, as you only pay for the cover as and when you need it. Provided the vehicle is taxed, affordable cover can be taken for terms as short as just one hour, right up to 28 days, with quotes available in 90 seconds. This provides you with peace-of-mind when your annual policy is due to expire that you are still legally insured to drive, while you give yourself the opportunity to research the annual policy that best suits your needs.

2. Buying a new vehicle

While getting a new set of wheels is an exciting prospect, it can also be stressful when it comes to getting cover. With the ongoing lockdown restrictions, many dealerships are now offering Click & Collect and Home Delivery options. Some of these propositions include short-term cover as standard while the car is in transit or under moneyback guarantee, but these are generally still quite limited. So, while getting caught up in the excitement of signing the ownership papers for the new vehicle, many motorists are hit with the reality that they are not insured to drive the car.

In this situation, most people opt to contact their annual insurance provider to get cover on the spot, without having the opportunity to do the due diligence to get the best deal. This is another example where temporary insurance could be more time and cost effective, as drivers can obtain fully-comprehensive cover following a few simple steps. This takes the stress out of searching for annual insurance on the spot and provides the driver with near instant cover so that they can immediately drive their new car and thoroughly research the best annual policy to suit their needs at a later date. An added benefit is there’s no risk to any existing No Claims Discount, as it’s a separate and standalone policy.

3. Car sharing

Whether you are sharing the driving on a long journey or borrowing or loaning out your car to friends and family – make sure you have the relevant cover because, chances are, your annual policy will not fully cover it! In fact, most annual insurance policies are becoming increasingly restrictive in terms of covering additional drivers and, beyond a small sentence on the certificate of insurance, there is very little in the way of specific information for drivers to find out whether they would be covered to drive another car. As a result, the onus is increasingly being put on drivers to find and interpret their individual policy wording before getting behind the wheel of another car.

While you’re unlikely to find out if you are covered to drive other cars under your policy before buying it, what you can find, if you search hard enough, is the growing number of restrictions that insurers are putting on the clause. This means that if you were to drive a friend or family member’s vehicle and had an accident, you and the vehicle owner could be left with a huge repair bill for the car, and you’d lose your No Claims Discount. In this scenario, it is safest to add the named drivers to the vehicle policy, but this may prove to be time consuming and costly, depending on the insurance provider. Again, this is where temporary insurance can add real value, as drivers can get quotes for fully-comprehensive cover in just 90 seconds following a few simple light-touch steps.

Click here to get your temporary insurance quote today.