Every driver should be fully aware that it’s against the law to drive without insurance. So whatever you’re driving – from your own car to a vehicle you’ve borrowed – it’s critical that you check you have the right kind of cover in place.

That cover can be an annual policy, or short term cover, but you need to be happy that it’s appropriate for you, the vehicle, the kind of driving you’ll be doing and the period of time. Counting on a policy that has expired is not going to help you in the event of an accident, nor is a new policy that doesn’t adequately cover you.

So always check if your car is not just insured, but properly insured, for total peace of mind.

How to find out who your car insurance is with

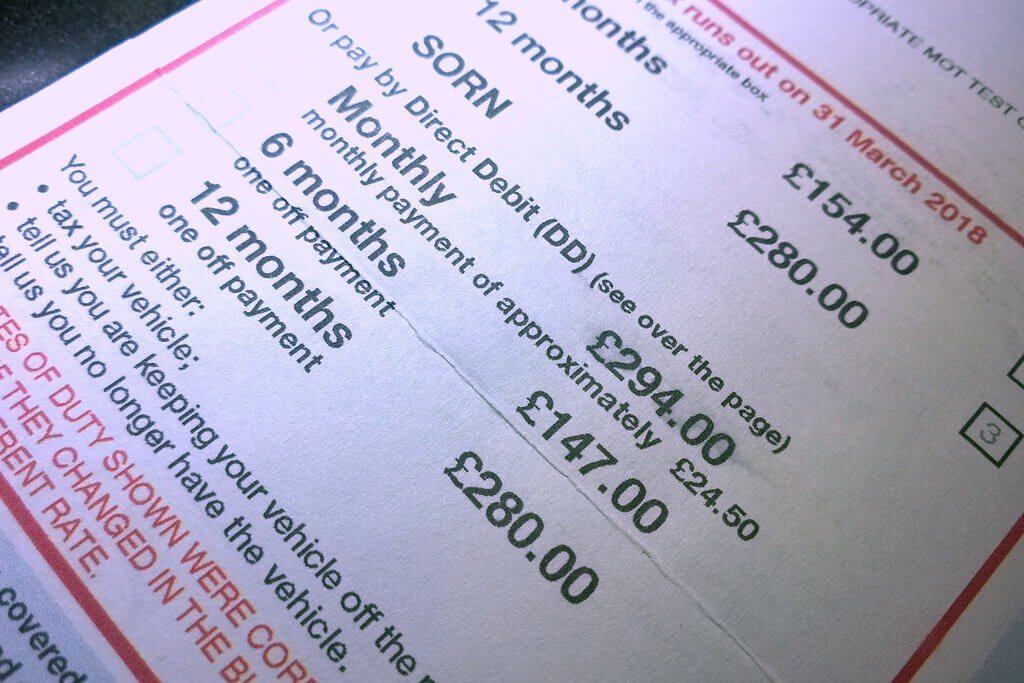

One of the simplest ways of checking your car insurance is to find your policy documents. All the documents you were sent when you took the policy out, most importantly your certificate of insurance, will give you all the information you need. Sometimes they are printed documents sent through the post, but often they are just emailed. The certificate is your essential proof that you are insured. So if you were stopped by the police this is what they would need to see.

It has all the key details on it, including your policy number and the start and end date. Don’t forget, just because you’ve purchased a car insurance policy, doesn’t mean that you’re covered immediately. Whether you’ve taken out an annual policy, or short term cover, the start and end date listed on the certificate are when you are covered for. If the start date is later than the current date then you’re not yet legally insured.

What if i don’t have my policy documents?

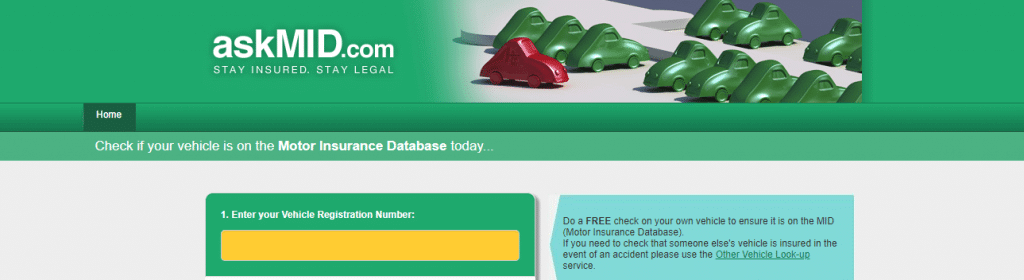

If you can’t find your policy documents, don’t panic. You can still check if you’re insured by going online to the Motor Insurance Database (MID).

The MID is the UK’s central record of all vehicles and their insurance. If yours is insured, then it should be there. Checking if your car is covered won’t cost you a penny, but if you want more personal information such as the specific details of the policy, there’s a small charge of £4. Lots of law enforcement agencies – such as the police – use the MID to see if drivers are uninsured.

If you’re caught driving without cover, it’s all they need to be able to fine you, or potentially take you to court. And while it might be tempting to take the risk, the repercussions can be very serious, and even the least serious can be considerably more inconvenient and expensive than simply taking out cover in the first place.

What if i’m driving someone else’s car?

If you are borrowing someone else’s car, either a friend, family member, or even the business where you work, then you still need to check that the policy covers your journey or journeys. Simply being reassured by the owner that you are covered won’t be enough if you are stop by the police or find yourself in court.

The policy needs to explicitly cover you, and if you are not convinced that it does then temporary cover for the duration of the drive is easy and affordable. Short term cover from Tempcover will give you the peace of mind you need and ensure that you’re not going to end up answering difficult questions.

What if i do drive without insurance?

Driving without insurance is against the law, and it’s no excuse to claim you didn’t know, or that you couldn’t afford it. It doesn’t matter whether you pop to the shops in a friend’s car, or just hope for the best with your own. If you are caught – and there’s a good chance you will be – you will be fined or worse.

At present, the least worst result would be a minimum fixed penalty fine of £300. But if you were to be involved in an accident, you may find that fine going up, in fact there’s no maximum penalty in place. If you go to court you may find yourself explaining to a judge why you made the decision, all of which is a lot more stressful and expensive than simply taking out a policy.

As well as a fine you will find that you will get at least 6 penalty points added to your license. If the conditions warrant it, you could even find that you are disqualified from driving. Don’t forget also that your vehicle could be seized and even destroyed if it’s not claimed in time. All of which can cost you money too, from admin fees to impounded car insurance. So if you’re trying to save money, you’ve probably already realised that it’s a lot more cost-effective to just take out the policy.

Why is my temporary insurance not showing on the MID?

Short term insurance – like temporary car cover from Tempcover – doesn’t always appear on the MID immediately – it can take up to seven days for a policy to appear, a time limit set by the MID. So if you’ve taken out temporary insurance and can’t find it on there, there’s no need to lose sleep about penalties or visits from the police. Tempcover update the MID on a daily basis, but details don’t always reach it for a few days or up to a week. In fact, if you’ve taken out a very short policy, such as just one day, you may find it’s expired before it appears.

As long as your certificate of insurance shows that you’re covered for the dates you need, then you are insured and fine to drive. Keeping your certificate to hand on the road may help you resolve any issues quickly, too. But if you do have a problem, a quick call to your insurer should be all it takes to confirm that you’re safely covered and well within the law.