Sometimes it’s necessary to cancel car insurance. There are lots of reasons why you might want to do this, from changing your mind during the cooling-off period, to having sold your car.

So if you don’t need your car insurance anymore, here’s how to cancel it with the minimum of hassle.

Step one: tell your insurer

The first thing you need to do is let your car insurer know that you need to cancel your cover. If you’ve only just taken your policy out, then you have a 14-day cooling-off period by law (please be aware that this does not apply to short term policies of less than one months duration – you can check this by reading the rules around cancellations on the Financial Conduct Authority website in section 7.1.3). This means you can cancel without issue and will be refunded for any money you’ve already paid.

If your cover has already started, then there may be an admin fee to pay, and you’ll be charged for the days during which your car was insured. The later you leave it, the smaller your refund is likely to be. So if you know you want to cancel, it’s a good idea to get in touch with your insurer as quickly as possible.

How much does it cost to cancel car insurance early?

Insurers are required by law to give you at least a 14-day cooling-off period, which makes this the best time to cancel your cover. The 14 days begin when you receive your policy documents, or when you’ve chosen for the cover to start, whichever is later.

While you’re allowed to cancel the policy in its entirety, it’s not entirely free. Your insurer may apply an admin fee to cover costs – it might not be a lot and is probably less than the fee you’ll pay outside the 14 days, but it’s still a cost you might not be expecting.

Take a look at your policy documents to see exactly what that charge might be, and whether you have more than the 14 days required by law.

How much does it cost to cancel during the policy?

If you want to cancel your car insurance part way through the policy term, for instance, if you sell your car, you can still get money back if you paid upfront. However, you will probably be charged cancellation fees, which can vary from insurer to insurer.

Often, these are calculated based on the length of term and overall cost of the policy. Additionally, you may not be refunded for any add-ons you chose, such as legal cover. And you won’t get to add anything to your No Claims Discount.

Again, you should always check your policy beforehand to work out what those charges might be. If you have sold your car, don’t delay in cancelling your car insurance. You don’t need it anymore, so you need to draw it to a close, especially since any accident the new driver has in your car could result in a claim against you.

What if I’ve already made a claim?

There shouldn’t be a problem cancelling your car insurance if you’ve already made a claim. However, you’ll probably need to pay the entire policy price in full with no refunds. If you chose to pay monthly, you may have to pay for any outstanding months up front.

Cancelling car insurance paid monthly

Many of us choose to pay for our insurance monthly. Spreading the cost takes the sting out of a single payment, and can be preferable even if it costs a little more over the year.

But even though it feels like a ‘pay as you go’ contract, it isn’t. When you take out an annual insurance policy, you are committing to the full cost for a year. Paying monthly is essentially a loan of the majority that you pay back month by month. So if you cancel your insurance, you don’t simply get to cancel the direct debit and walk away.

If you want to avoid being chased for unpaid premiums, then you need confirmation from your insurer that you have cancelled. With that confirmation will probably come a standard cancellation fee, and a charge for the percentage of the total policy.

All of this may seem unfair, but that may be that you didn’t look closely at the contract you were getting into in the first place. However, it actually might be unfair. If you think you are being overcharged then you may want to make a complaint.

Complaining about your car insurance company

If your insurer won’t refund you in any way, or their offer is substantially less than it should be based on a pro-rata calculation, then you probably have grounds for a complaint. In this instance, you should get in touch with your insurer directly and tell them. They should have details of their complaints procedure readily available on their website.

Make sure you keep a record of any contact you have with them. Your insurer has eight weeks by law to make a final decision. If you’re still not happy with that decision you can take the matter to the Financial Ombudsman Service.

Watch out for automatic renewals

Working out how much it will cost you to cancel in advance can be sensible, and it may work out more cost-effective to simply wait for your policy to expire. If so you should check on your insurer’s process for auto-renewal. If they automatically renew, you’ll need to get in touch at that time to stop it rolling over, in order to switch to something new. Changing insurers almost always guarantees a better deal, as insurers don’t generally reward loyalty from customers.

What if my insurer cancels the policy?

If your insurer cancels the policy on you, and not the other way around, don’t drive your car until you know you have cover in place. Complications such as making modifications to a car can cause some insurers to make a cancellation themselves, and if this happens you need to take action immediately. Even if your car is simply parked on the road without insurance could be considered an offence and end up with you being fined.

Choosing a policy that works for you

UK law says that you must have at least third party motor insurance if you drive or own a vehicle, but if you’re not happy with your current policy then you may want to seek an alternative. If you feel you aren’t getting value for money with your current deal, then you may want to compare short term insurance.

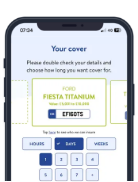

A temporary insurance policy could be a great option if you’re looking for ways to reduce costs. While different to annual cover, short term car insurance still provides you with the same level of comprehensive insurance but for a duration that works for you.

If you’re considering getting temporary cover, you will likely be accepted if you:

- Are aged between 18 and 78 years old

- Are the holder of a UK or EU driving licence

- Have held your licence for at least 6 months (12 months for EU licenses)

- Are looking to insure your car which is valued between £800 and £65,000.