What does ‘car insurance groups’ mean?

The car you drive has always had an impact on how much your insurance costs. Bigger, faster, more expensive cars cost more to insure, for obvious reasons. But how this is worked out isn’t so obvious. The system used is called The Group Panel Rating, devised by Thatcham Research. There are 50 separate groups, each with their own specific associated risk calculation. Your car will fall into one of them.

The lower your car insurance group number, the lower your insurance, and vice versa. Simple, right? Essentially the whole system is designed to keep costs low for people who drive modest vehicles compared to people who drive very powerful, often modified cars.

It’s not the only factor impacting how much you pay. Your age, experience and location can all contribute, but the car insurance group plays a role.

So now you know how it works, how do you find out which insurance group your car is in?

How is my car insurance group worked out?

Many people think that engine size is the only factor determining which of the 50 insurance groups your car falls into. But this is a myth. Engine size is important, but it’s just one of many factors used in the calculation. Here are the others.

How much is your car worth?

If the worst should happen, your insurer may have to replace your entire car. Which means that if that cost to them is quite low, your grouping will be quite low. But car value can range wildly from a few hundred pounds to several hundred thousand pounds. So if you drive a Bentley, then you can expect your insurance group to be quite a lot higher than if you drive a Nissan Micra.

How high is your car’s performance?

High-performance vehicles – in other words, cars designed to go very fast – will generally sit in a higher group. There’s a consensus among insurance firms that the higher the performance, the higher the likelihood of a claim. This is partly because people who buy high-performance cars like to drive them fast, and the risk of collision goes up. In the case of car insurance groups, slow means low.

How long would your car take to repair?

Many cars are extremely popular, affordable and common, which makes them easy to repair. However, if your car is older or more unusual, then you may find the cost of repair goes up and, like the overall value of the vehicle, so does the grouping and cost of insurance. Parts can be a pain to get hold of, especially if they need to be imported from overseas. One of the most common parts that need replacing is the bumper. If your car has a generic form of bumper that is easy to source, it will help to bring your car insurance group down.

How safe is your car?

Unsurprisingly, the safer your car is the lower your group rating. In the event of a collision, the less reliable the car, the greater the damage, the higher the cost of the repairs. Since modern cars are generally built to be safer than older ones, this tends to improve by default year on year, so if your car is quite new you may find you have one of the best Euro NCAP safety ratings possible. Unlike your car insurance group, the higher your Euro NCAP, the better and safer your car is, and the lower your group. The lower the rating, the higher your insurance group is likely to be.

How secure is your car?

Similarly, the more secure your car is will also help bring your group down. Insurers will generally favour more secure and therefore lower risk cars, since they are less likely to be stolen. You can’t change your car’s safety rating, unfortunately, but you can improve its security by making a few simple changes.

So, what group is my car in?

If you don’t know what group your car is in, it’s easy to find out. While some insurers use their own grouping systems, most rely on the Thatcham Research criteria – the company that set up the grouping system. All you have to do is visit thatcham.org and enter your car’s details to instantly find out your group.

My car is in a high group. Can I lower the cost?

Car insurance groups are not set in stone. Insurance companies don’t have to use them, but they generally do to give them a guide of risk. You can’t trick the system, if your car is obviously higher risk, there’s no nifty way of getting out of it. But there are things you can do to help bring the cost of cover down a bit.

- Don’t pay for anything you don’t have to – if you’re not going to be driving the car for a year, don’t take out an annual policy. Just insure yourself for what you need.

- Secure it to the max – If you don’t have the best level of security for your car, then get it. Alarms and immobilisers can easily be retrofitted, and if you don’t lock it in the garage overnight then maybe you should start.

- Leave your car alone – don’t make modifications. The moment you do, you’ll be going up the groupings.

- Raise your voluntary excess – this can reduce your premium, as it will for any insurance quote, but don’t forget that you need to be able to afford it if you did need to make a claim.

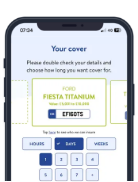

If you’re looking for cheaper car insurance, you may want to consider a short-term cover option. But, you might be asking, how much is temporary car insurance? To find out, simply click ‘get a quote’, enter your details get a quote in seconds.