Like insurance, tax, and MOT are essential requirements for the vast majority of cars owned and driven in the UK.

This has been the case for a long time, although the system has evolved enormously over the years. Car tax rates set by the DVLA have changed significantly, in fact, a great many drivers now have to pay hundreds of pounds more. Similarly, the tax disc – once a mandatory feature of every car on the road, providing proof of that tax had been paid – is no more. It was swapped by the government for an entirely digital system back in 2014.

While the tax disc has gone the way of the CD, it’s left something of a hole. It used to be easy to see when your tax was due, or when anyone’s was due for that matter. Without that handy reminder, it’s much easier to forget when the date comes around.

The same is true of your MOT, and failing to get it done in time can hurt. Driving without a valid MOT certificate, or without car tax, could both result in a fine up to £1,000. So how do you check if your car is taxed or has an up to date MOT, to save yourself that kind of nasty surprise?

Is my car taxed?

Checking that your car is up to date with its tax is a relatively simple process. The government’s website gov.uk offers a straightforward search function that lets you find out if your covered, or need to take action, in minutes. It helps if you have the registration of your car to hand, but that’s all you need.

Enter the registration and you’ll be instantly taken to a page that clearly shows you the due date of the vehicle, along with other essential information.

How can I make sure I don’t forget my MOT?

If you’re worried about forgetting your MOT due date, there’s a straightforward way to guard yourself against a fine. The DVSA (Driver and Vehicle Standards Agency) offers a Get MOT Reminders service, and it’s free. A month before your car’s MOT is due, you’ll get a notification so you have plenty of time to get the test arranged. You’re not alone in wanting a little nudge. A million other people already use the service in the UK.

How can I make sure I don’t forget my car tax?

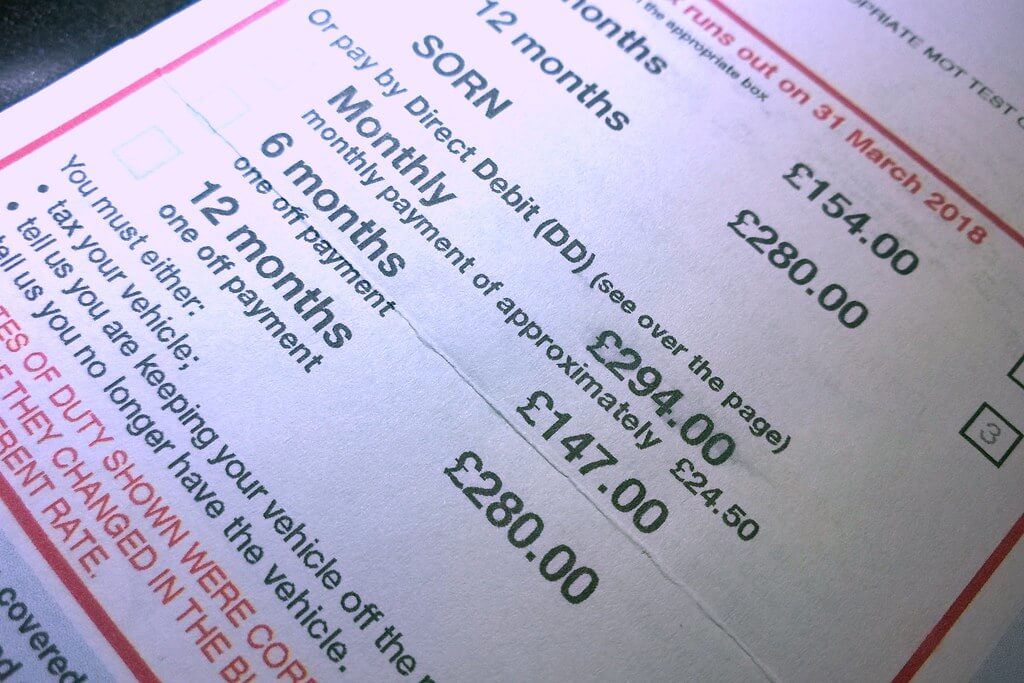

You don’t need to worry about missing your tax due date either. All drivers are sent a V11 reminder letter a month before their car tax expires. It clearly outlines the registration, when you need to pay and how much. You can choose between monthly direct debits or a one-off payment.

The good news is it’s quite easy to make sure your car is taxed and has an up to date MOT in time. (If you’re anxious, you may want to make a note on your calendar for a little extra reassurance). But that means that if you miss the deadline, you’ve only got yourself to blame for any fines you incur.

What happens if my direct debit doesn’t come out?

Spreading your monthly payments can make it easier to afford your car tax, but you need to make sure that you have the funds in your bank account. If a payment to the DVLA fails, you will be sent an email and four days later the payment will be attempted again. If it fails a second time, you’ll receive an email informing you that the direct debit has been permanently cancelled and that your car is no longer taxed.

Because it’s a crime to drive a vehicle without tax, that could put you in a difficult position. You’ll need to set up a new direct debit with sufficient funds or arrange payment by another method if you want to keep driving your car. If you don’t, you could be fined £80.

Can I buy a car that’s already taxed?

Unfortunately, road tax no longer carries over with ownership of a vehicle. So if you buy a car that has three months tax already paid, you still need to pay road tax from the day you own it, if you want to drive it. If you sell a car that still has part of the year’s road tax left over, you can ask to be reimbursed, however it will be taken from the first of the next month. So if it’s the 15th of the month, you’ll still be charged for the weeks until the new month begins.

No road tax means no insurance

It’s worth bearing in mind that if your car isn’t taxed, then it isn’t insured either. This means that you are at risk of being fined, which is bad enough news as it is. But not only that, you could be in even more serious trouble if something happens to your car. For instance, if your car is stolen, or you’re involved in an accident, your insurance will be invalid and you could encounter some even more substantial bills.

If you decide to export or scrap your car, you need to tell the DVLA as quickly as possible. They will tell you to apply for a SORN – a Statutory Off Road Notification (SORN). As long as your car remains off the road, your SORN will remain valid and won’t need to be taxed. But the moment you want to put it back on a public road, even if you just want to park it outside your house, then you’ll need to pay your road tax.

If you’re looking for a temporary solution, you may want to consider getting a short term insurance quote. While temporary and annual cover may be different, a short term car insurance policy provides you with the same level of comprehensive insurance but for a duration that works for you.