It’s no secret, applying for motor insurance is seen as a cumbersome and time-consuming process that very often leads to confusion about what is (or isn’t) covered in the policy. Long call times, excessive questions, and endless paperwork make it an experience that most people want to avoid and only do it because they know it is a ‘necessary evil’ that they can’t do without.

But the industry has made significant strides with InsurTech advancements such as artificial intelligence (AI), machine learning (ML) and deep learning (DL) over the past decade, and that has been significantly accelerated in the past year, leading to usage-based insurance (UBI) models moving from relatively niche obscurity into the mainstream.

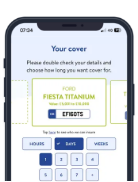

A major driver of this shift is the fact that UBI is considerably more convenient than traditional insurance models, as it provides flexible and temporary cover for the time drivers actually want – just a few quick and simple steps from a mobile device resulting in fully comprehensive cover being issued in under two minutes. Best of all, there are no lengthy and invasive phone calls, no long-term commitments based on uncertain vehicle usage, and no auto-renewals.

These are significant advancements that would have been unheard of years ago – so where are we headed in the next 10 years and what are the potential outcomes that seem incomprehensible now but have every chance of becoming a reality and part of everyday life in the not too distant future?

UBI to move from industry niche to norm by 2030?

According to a recent McKinsey report [1], insurance will shift from its current state of ‘detect and repair’ to ‘predict and prevent’, transforming every aspect of the industry in the process. It predicts that the pace of change will also accelerate as brokers, consumers, financial intermediaries, insurers, and suppliers become more adept at using advanced technologies to enhance decision making and productivity, lower costs, and optimise the customer experience.

Because products are tailored to the behaviour of individual consumers, the report notes that UBI products such as temporary car insurance are expected to proliferate as insurance transitions from a ‘purchase and annual renewal’ model to a continuous cycle, because product offerings will constantly adapt to an individual’s behavioural patterns.

It predicts that there will be increased focus on sophisticated proprietary platforms that connect customers and insurers and offer customers differentiated experiences, features, and value. Where this change is embraced, the pace of pricing innovation is rapid. As pricing becomes available in real time based on usage and a dynamic, data-rich assessment of risk, consumers become more empowered to make decisions about how their actions influence coverage, insurability, and pricing.

Digitise or die?

This might sound extreme, but it is a fact. A KPMG report on insurance insights [2] cites this as trend number one in the evolution of the industry. The development and adoption of InsurTech has a clearly defined progression. The first of these two phases began with a focus on digital distribution and data, the second was heavily focused on sales and marketing. In the first phase, the underlying insurance product remained largely unchanged, but some parts went digital. The second has seen the emergence of risk carriers that are changing the underlying insurance product and using InsurTech to automate the value chain. This second phase has seen considerable advances in new sources of data and the ways in which data is processed.

Embrace innovation to succeed

The greatest innovators are poised to have the competitive advantage, not only because they are doing things never previously conceived, but because they are early adopters / developers of technology that incumbents have yet to embrace. Adoption of the latest InsurTech that streamlines the user experience is not a simple case of bolting on a few peripheral systems. It requires total transformation of the existing business model.

How insurers handle this repositioning of the business strategy will likely determine whether they are considered a tinkerer or transformer and indicate how sustainable their business will have become. The report goes on to add that the industry may well have been transformed in just three or four years, and no longer than a decade. This means insurers must have a digitally focused and automated digital-first/customer-first business that would be comparable to the tech giants of today.

Collaboration is key to future success

The future of insurance is already well and truly here. These latest industry insights are spot-on, and perhaps even conservative in terms of timings given all that has happened particularly over the past year. For many InsurTechs, UBI policy sales and revenues have steadily risen throughout the lockdown, as some of the larger and more traditional insurers have struggled with legacy systems that are unable to swiftly adapt to rapidly changing market conditions driven by a seismic shift in consumer trends.

In such tough economic conditions, this is evidence that the market is warming to UBI. This doesn’t necessarily mean that motorists are turning their backs on the annual policy model in favour of UBI. Instead UBI should be viewed as more of a complementary, flexible add-on to an annual policy, not a mainstream replacement per se. To this end, brokers and insurers should aim to work more collaboratively to offer motorists the most flexible and fit-for-purpose solution at a fair and affordable price in a time where rapid market changes means that brand loyalty is no longer a guarantee.