It’s time to sell your car, but where to start? The world of car sales can seem daunting if you’ve never sold a car before, due to the sheer number of ways to go about it. The best option for you will very much depend on your circumstances as well as the time and effort you have to put into selling your car. Do you need to sell your car fast? Or are you in no hurry? How you sell a damaged car? Would you consider a trade-in? Thankfully, selling your vehicle is easier than you might imagine, and you don’t have to be a sales whiz or a car expert to sell your car quickly for a good price. The Ultimate Guide to Selling Your Car will cover everything you need to know from selling your car privately, selling a damaged vehicle, options around vehicles with finance, and the best time to sell.

Options for selling your car

Choosing the best way to sell your car might seem overwhelming at first. There are a number of ways and each has its own pros and cons. It’s important to do your research to understand which method best fits your individual circumstances, and that’s exactly where we come in. Let’s look at your options:

Selling a car to a dealer

Selling to a dealer is generally one of the quickest and easiest ways to sell your car. If you’re looking for a hassle-free way to sell your car fast and you don’t necessarily need to maximise how much you get back for it, this could be the way to go. This option could include taking your car back to the garage where you originally bought it from, or to a specialist dealer. This could be an especially smart move if your car is still quite new, has low mileage, and is in good condition. Mainstream vehicles that have been well-cared for will appeal to small dealerships. If you have a niche model that’s in-demand, then a specialist dealer who understands the value of the car might be your best bet. One of the other advantages of selling to a dealer is that it opens up possibilities for trading in your car or part-exchanging it and driving away with a new vehicle.

Part-exchanging

Franchised dealers are often happy to accept good-quality used cars if they believe they can resell them, and independent dealers will usually be open to part-exchange deals. Of course, dealerships will be looking to make a margin on any second-hand car, so you may not get as much for your vehicle as you would through a private sale, but there are definitely deals to be had, especially if you feel confident negotiating with them. When negotiating, instead of focussing on the individual price of your car and the new one being offered, look at the ‘price to change’ which is the difference between the offer on your old car and the cost of the new one. The way this can work is that a dealership might give you a great price on your car if you’re willing to pay close to the asking price for the new car and vice versa. Online part exchanges are also possible if you’re buying a new car that way, although like other online sales you may get offered less.

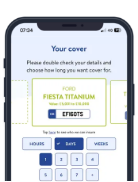

Online car-buying sites

This is another option if you want a fast and relatively hassle-free way to sell your car quickly. Online car sites can give you a quote for your car based on the age, make, model and mileage, and the money can be paid straight into your bank account. Here’s a quick checklist of the information you could be asked to provide by websites to get started:

- The car’s registration (number plate)

- Mileage

- Number of previous owners, if known

- Service history – full, part, none?

- The condition of the car

- Your contact details

The ease and speed of this option does sound appealing, however, it’s important to know that the online valuation is only maintained once the car has been physically inspected, and you’re likely to get less money from these companies than if you are selling your car privately, via an auction or at a dealership.

Car auctions

There are different types of car auctions available, including large and established national auctions, local auctions, live auctions where you personally attend and hand over the car there and then if it sells, and online auctions (such as eBay) where you list the car on a website with photos and a full description. The advantage of an auction is that it can be quick and hassle-free, and you can end up selling to both dealers, people from the car trade and private sellers. However, you will have to pay a fee to put your car up for auction, and there’s no guarantee your vehicle will reach its reserve price. You could end up getting less for it than selling it privately or to a dealer.

Selling your car privately

If you’re willing and able to put the required time and effort in, selling your car privately is usually the best way to maximise the price and get the most money back. Unlike selling to a dealership, or online car buying websites, the emphasis is on you to do the leg work. We’ll go into detail about selling your car privately later in our guide, but here is a quick checklist of what you’ll need to do:

- Get your car ready for sale – This includes thoroughly cleaning and preparing the interior and exterior of the vehicle. It might be worth investing in minor repairs. Also, if you’ve got a spare key this could help with the valuation.

- Gather the documents you need – V5C logbook, MOT certificate, service book, manual, invoices and receipts for work done or parts purchased, plus your passport, driver’s licence or utility bill to prove your identity and address.

- Set the price – Do your research into the current market value of your vehicle by using official car valuation tools as well as checking websites, private adverts, car magazines and dealerships to establish a competitive price that works for you.

- Advertise to potential buyers – There are lots of ways to advertise, including online websites, social media such as Facebook marketplace, and classified adverts in newspapers, car magazines and trade publications.

- Make sure your description matches the vehicle – It’s always best to be honest and transparent.

- Be prompt and professional with enquiries from potential buyers – this is a business transaction and any delays or unprofessional behaviour could lose you a sale.

- Organise and attend viewings and test drives – Make sure any potential buyers have car insurance. They may want to consider temporary cover for a test drive.

- Arrange a secure way to be paid for the sale – would you consider cash, debit card, credit card, bank transfer or another method? Make sure you’ve weighed up the pros and cons and you’re comfortable.

What’s the best time to sell your car?

They say timing is everything in life and that’s also true when it comes to selling a car. While it can vary depending on the type of vehicle you’re selling and the method you’re using to sell it, here are some general tips for the best time to sell:

- The newer your car, the more you’re likely to get for it. If you want to maximise the resale price then you might want to sell before your car is five years old, and before it has reached 60,000 miles.

- Sports cars and convertibles are more likely to sell in the summer

- Similarly, four-wheel drives and vehicles in this range will be more popular in winter and colder months with typically worse weather conditions.

- If you’re part-exchanging, it might be worth choosing a time when business tends to be slower at dealerships, such as December and January, March and August.

- We’re often asked how road tax works when selling a car. It’s important to know that road tax can no longer be transferred to the new owner, so the timing of the sale in terms of the tax is worth considering. Because new tax is backdated to the beginning of the month and refunds are set from the start of the next, if you sell your old car and then buy a new one early in the month, you will be paying tax twice. You can avoid this on your existing car if you apply for SORN (Statutory Off Road Notification) before the end of the month. However, you could receive a fine if you drive on the roads untaxed after this point, and this could make it difficult to test drive your car.

- On the subject of test drives, your potential buyer may also want to consider cheap short term temporary insurance to cover the test drive in case they have an accident.

- As you’ll need to pay off any outstanding finance on the vehicle, you may also want to consider the timing of your sale in relation to how long you’ve got left on your finance agreement, and any penalty fees you might incur. Finally, when the time comes, you’ll need to let your insurance company know when you’ve sold the car.

Selling a broken or damaged car

Just because your car is broken or damaged, it doesn’t mean you can’t sell it. You have several options and depending on which one you choose; you could still get a good price for the vehicle.

How do I sell a broken car?

Before you sell the vehicle, you might want to consider whether the damage could be repaired. If it’s cost-effective to do this and you’ll make more money from the sale than it would cost to do the work, then this might be worthwhile. However, if you’d rather just sell the car, or the damage is too great or too expensive for you to have fixed, then you’ll need to look at buyers who will accept broken vehicles. The first step is to look at the level of damage – could a dealership (or a private buyer) conceivably repair the vehicle, or is it a write-off i.e. beyond or too expensive to repair?

Thankfully, to prevent any confusion around this, the Association of British Insurers (ABI) has come up with four distinct categories of car damage:

- Category A – Scrap

Vehicles which are not suitable to be repaired. No parts of the car are allowed to be reused for salvage and the entire vehicle must be scrapped.

- Category B – Break

Same as above, but some of the vehicle’s parts may be used elsewhere.

- Category S – Structural

Vehicles which have received damage to the structural frame or chassis. This rating is when the owner and/or insurance company chose not to repair it, however these vehicles can be used for salvage.

- Category N – Non-Structural

These vehicles do not have any structural damage and this category is given to repairable vehicles, where the owner and/or insurance company decided not to proceed with repairing the vehicle.

Your options for how and where to sell your damaged car will largely depend on which category of damage your vehicle falls into. As well as selling your car for scrap or salvage, there are networks of buyers who specialise in faulty or damaged vehicles, so don’t despair as you may still be able to get a competitive price. If a vehicle is scrapped, it will often be an end-of-life vehicle and will be taken to a government Authorised Treatment Facility (ATF), where it will go through a depollution process before being safely disposed of and recycled. Payments for scrap can vary between companies and also depend on the vehicle, so be sure to shop around and compare offers.

Can you trade in a damaged car?

Yes, although the nature and scale of the damage will impact the price or part-exchange equivalent value you’re offered. A dealership might feel there is still money to be made from the car, or from selling it for parts. Similarly, if the dealer has another car of the same make and model as yours that’s sustained a different kind of damage, then it might be possible to use parts from one to repair the other.

How do you sell a car privately?

Selling your car privately is usually the best way to get the most money for your old vehicle, but it’s also the most time-consuming and labour intensive for you. Of course, if you’re willing to put the time and effort in, it can definitely be worthwhile. You’ll be cutting out any middlemen, whether online or via a dealership, who could charge you a fee for their time, so the money from the sale will go straight into your own pocket. Here is our list of top tips for selling your car privately before, during and after the sale:

Before you put your car on the market

Getting your car ready to be sold is arguably the most important step in the selling process.

- The right car at the right price – Do some research to find out what price similar makes and models are being sold for. This will likely vary depending on the age and condition of the car, but you should get a rough idea of what you can expect to get. For a more specific idea, you can use a free car valuation tool online.

- Ensure your car is in the best possible condition – before taking any photos make sure you clean your car thoroughly and consider paying for any minor repairs that might enhance the saleability of the car, without cutting into your potential profit.

- Find all the spare keys and accessories

- Consider getting a MOT done – A car which has just had its MOT is much more attractive (and less of an unknown quantity) than one which needs one. There are no guarantees of course, but having a recent MOT can go a long way to reassuring prospective buyers that they are not going to have any unpleasant surprises with your car.

- Get your paperwork in order – What papers do you need to sell your car? Here’s a quick checklist to help get you organised:

1) V5C logbook,

2) MOT certificates,

3) service book,

4) manuals,

5) any significant invoices and receipts for work done on the car.

- How will you attract buyers? – You’ve got the car spick and span; you’ve got your paperwork ready and you’ve set a price. The next challenge is to bring your car to the attention of potential buyers.

- Where to advertise your car? – Thanks to the internet and social media it’s now easier than ever to get your car seen by thousands of potential buyers. You can still use traditional online sales site like AutoTrader or Gumtree, but this can come with costs depending on your advert. If you don’t want to pay for any online advertising, try Facebook Marketplace, various local buy/sell Facebook groups, or even dedicated car club or enthusiasts pages. You can also try searching for specific hashtags or accounts on Twitter. If you’re more traditional and prefer to advertise offline, you can try newsagents in your area or classified adverts, but this could come with a small cost. You can also stick ‘for sale’ signs in your car with a contact number, so buyers can see it while you’re driving around, or while it’s parked up. Obviously, you should tell your friends, family or colleagues that you’re selling your car too – they might be looking to buy and can also help spread the word.

- Writing the advert – When it comes to writing your car listing or advert, you want to be as honest as possible while at the same time selling your car in the best possible way. Here’s a checklist of key information to include:

- Make & model

- Engine size

- Engine type

- Millage

- Age

- Condition

- Date of last MOT (especially if you’ve just had one done)

- Photos – These could make or break the advert, so we’ve put together some additional advice directly below.

- Photos advertising your car – It’s important to make sure that the photos are well-lit, so it doesn’t look like you’re trying to hide anything, and you can show off your freshly-cleaned vehicle. Try to include multiple shots of the cars from various angles, including images of the boot, under the bonnet and the interior. If there are major dents or scratches that are so prominent you had to mention them in your advert, be sure to include a close-up photo. This way buyers will know what to expect and it will save you having to waste your and the buyer’s time.

During the sales process

Now that you’ve got your car prepped and the advertising campaign has begun, it’s almost time to sell it:

- What to do during a viewing – It’s generally easiest to have people come to you. However, if you’re uncomfortable having people come to your home, you could arrange to meet somewhere neutral like a supermarket car park for example. Wherever you choose, it’s probably best to arrange viewings for the daytime and avoid bad weather (where possible), so buyers can get a good look at the car. Be prepared to answer any questions they might have about the car, and be sure to have the necessary paperwork to hand.

- Be friendly, relaxed and helpful – People don’t like pushy or overbearing salespeople. Give the buyer some time with the car and offer the chance to take a test drive if they wish.

- Going for a test drive – Allow about 30 minutes for the test drive to give your buyer time to try out the steering, brakes and gears on different kinds of reads. As you’ll be using public roads during the test drive, you need to make sure that the buyer is insured to drive your car, before you set off. Without the correct insurance, you and the person driving your car could be fined and liable to expensive costs, if there was an accident.

If the other driver does already have insurance, it’s unlikely they will want to adjust their existing annual cover for a car they may or may not buy, and unless their policy has a Drive Other Cars (DOC) built in – something that’s not as widely available now – they’ll need another insurance option. Short term, temporary car insurance cover is ideal for test drives when you’re selling your car. It’s fast, flexible and affordable cover, which lasts from 1-12 hours or 1-28 days depending on your needs. For test drives, cheap temporary insurance can allow the buyer to be insured to drive your car, without impacting on any existing insurance policies you or they have. Short term cover will also protect your No Claims Bonus (NCB) should there be an accident on the test drive.

- Negotiating the price – Most private buyers will look to haggle on your asking price, so make sure you’ve thought through how far you’re willing to lower the price, and what your bottom line is. Don’t be tempted to go below it.

- Closing the deal – Once you’ve agreed a fair price that you and the buyer are happy with you can shake on it (literally if you want) and the deal is agreed. If you can’t agree a price first-time, remain friendly and give the buyer the chance to go away and think about it.

After you’ve sold your car

You’ve done it! The car is sold, but there are still a couple of things left to do:

- Payment – You can accept payment in a variety of ways, depending on what works for you, including:

- Bank transfer – this is the most recommended method for receiving payment. You can receive almost instant payment and there is a record of it in both the seller and buyer’s accounts. Some accounts offer payment protection too.

- Cash (paid out at a bank) – You can accept cash in hand of course, but one reason to have the money paid at a bank is so the staff can check, verify and count the bills. They may also be able to provide a receipt of the transaction.

- Cheque or Banker’s Draft – these are less in use. However, if you do accept a cheque you may want to hold onto the vehicle until after the cheque has cleared and the money is in your bank account. Most private sellers avoid taking payments from credit cards for similar reasons.

- Using an ESCROW – this is a third-party who handles the transaction and can offer extra security to both sides. However, make sure they are legitimate and registered with the Financial Conduct Authority.

- Paperwork – Make sure you have all the paperwork and documents to hand over. You’ll also need to write two copies of a receipt. It should include the date, price, registration number, make and model, and both yours and your buyer’s names and addresses. While this won’t stop the buyer returning the car if you’ve mis-sold it or wrongly described it, it will cover you against the possibility that the car may be unroadworthy in some respect. Finally, you need to notify the Driver Vehicle Licensing Agency (DVLA) that you no longer own the vehicle. This last step is how you change the registered keeper of the vehicle. We have more information about this later in our guide.

Anything else to consider?

- Bonus Tip: Don’t forget to delete any sensitive data from the car. You may not associate your car with storing data, but if you’ve paired your phone with the stereo or in-built sat nav, then it could include all of your personal phone numbers, emails and any saved routes or addresses.

How to sell your financed car

Can you sell a car if you still owe money on it? The short answer is no, but there are a couple of ways to do it if you have a car with outstanding finance and you need to sell it. Car finance generally falls into two main categories – Hire Purchase (HP) and Personal Contract Purchases (PCP).

- Hire purchase (HP) – this involves paying a deposit, such as 10%, then repaying the balance, plus interest, over an agreed loan period. However, you don’t own the car until the last payment.

- Personal Contract Purchases (PCP) – this arrangement also features monthly payments. However, with PCP they are based on a loan calculated by the difference between the vehicle’s price brand new and the predicted value of the car at the end of the hire agreement. This means at the end of the contract you have to pay a ‘balloon payment’ to own the vehicle, hand the car back, or extend the arrangement by going straight into another PCP.

Regardless of the type of finance you’ve taken out, there is something very important you need to know if you’re thinking about selling a car you are currently paying for with car finance – it is breaking the law to knowingly sell a car with outstanding finance on it without informing the buyer.

However, it is possible to legally sell a car with finance left to pay if you do the following:

- You must tell the finance company your plans and ask them for the ‘settlement figure’ – this is the amount you need to pay off your loan in full.

- You will then need to pay this settlement figure, plus any early repayment fee and admin charge. Once you’ve done this, you will be in a position to legally sell the car.

You could still run into difficulties trying to sell the car however as the vehicle may temporarily appear on the HPI and Experian databases as being subject to finance. Savvy buyers use these sites and other resources to check a car’s history. One way around this would be to explain the situation to the buyer at the outset, as there is always the possibility that they will be willing to buy the car on the basis that you will use their money to pay off the remainder on your finance (plus, honesty is always the best policy!). This is easier if you are selling to someone who already knows and trusts you, such as a family member for example, or even a dealership which has done business with you before. However, it is generally much easier to pay off any outstanding finance before trying to sell your vehicle. The same goes for part-exchanging a car with outstanding finance.

A final way of legally selling a car purchased on finance would be when you have used a personal loan to buy a car outright. In this situation, you would own the car as soon as you used the loan to buy it and therefore have the right to sell it. Just bear in mind that you’ll still have to pay off the loan.

Telling the DVLA you’ve sold your car

Once you have sold the car, you will need to tell the Driver Vehicle and Licencing Agency (DVLA) to update the information they hold about the registered keeper of the vehicle. Until they’ve been notified, you’re legally responsible for the vehicle, so it’s important to get in touch with them promptly. You can do this by sending them the second part of the V5C (logbook) or by using the DVLA’s online service.

What’s next?

Now that you’ve sold your car, it could be time to reinvest your hard-earned profit and get back on the road yourself. After learning everything you need to know about selling cars from our ultimate guide you should be more than ready to go out and find a great deal on a new car yourself. While you’re looking, remember that you’ll need insurance if you’re going to be test driving new or used cars, especially if you’re buying from a private seller. Cheap temp car insurance is ideal for this, as well as a wide range of other circumstances where you don’t yet need annual cover.