If you’ve ever bought a new or second hand car from a dealer, you’ll know there is a moment – before they let you loose on the road – when they take a copy of your driving licence and sign you up to their insurance. No dealer wants to risk their precious metal on an uninsured test drive!

But what if you’re buying a car from a private seller? Are you insured to test drive their car, even if the owner is sitting beside you in the passenger seat?

Unfortunately, the answer in most cases is an emphatic No.

More importantly, should anything happen – an accident, or the engine goes boom – no one, the Police included, will accept “I’m test driving a new car” as an excuse for not having insurance.

Are you DOC covered?

There once was a time when most fully comp insurance policies included a benefit known as Driving Other Cars (DOC) that would cover you on a third party basis to drive someone else’s vehicle, provided you had their permission.

Originally intended to be used in emergency situations only, DOC inclusion has now become increasingly rare and seldom included as a default when purchasing an annual policy.

And, if you’re under 25, you can pretty much assume that DOC will not be included in your policy.

While you can of course contact your insurer to have DOC coverage added to you policy – usually for a fee – it’s a far from ideal solution for test driving purposes.

DOC would only provide you with third party coverage – in other words, while it might cover the cost to repair other vehicles involved in an accident, it won’t cover anything that happens to your test vehicle.

Potentially a difficult discussion between you and the vehicle owner!

Fully comp yourself

So, if you’re taking a private test drive, the safest and best option is to make sure you have fully comprehensive insurance, covering all parties should anything happen.

How to get covered?

While it’s tempting to first contact your existing annual insurance provider to adjust your coverage for a test drive, in practical and cost terms, you’ll find this is both time consuming and expensive.

By far the quickest and usually the cheapest option is to take out temporary car insurance, providing you with short term coverage for as long as you need it – an hour, a day, however long you intend to test drive the vehicle.

It can also be used to protect your own No Claims Discount.

Peace of mind

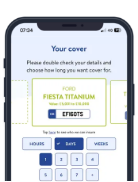

A further benefit of Temporary Car Insurance is that in many cases – as with this web site – you can sign-up and secure coverage in a couple of minutes flat. Meaning you can pitch-up to the test drive with an open mind, inspect the vehicle visually and then purchase insurance from the roadside, should you decide to progress to a test drive.

The process is so quick and easy that, in our case, we don’t even require you to tell us your occupation.

For further details on eligibility for temporary coverage click here or submit your details for a quote on coverage.