Quick and simple insurance

It was so simple to get insurance. Clear and easy guidance insured within minutes which allowed peace of mind when picking up new car on a weekend.

Yesterday

For many drivers, short term car insurance is the ideal option for those times when only a little bit of cover is needed. But how do we find cheap temporary car insurance?

Whether it’s borrowing a car for work or picking up your new set of wheels, it’s the quick and easy way to get comprehensive cover.

Once you’ve realised that spending hours on the phone trying to adjust existing cover or trying to buy a new annual policy can be a big waste of time and money, it’s time to start trying to find the right temporary policy that works for you.

It used to be common for insurers to offer the ‘driving other cars’ (DOC) clause within your policy which allowed you drive, as the name suggest other cars you weren’t insured on, usually with only third-party cover.

Unfortunately, because the increased risk and rising costs of insurance claims, most providers no longer offer this feature outright and require you to request permission.

Not only will you have to call your provider and pay around £30 in admin fees but if you are a young or inexperienced driver, you will often have to pay an increased excess if you have an accident and it could cause the vehicle owners premiums to rise.

You may also have trouble being accepted as a temporary named driver if you having any previous driving convictions or claims, something that temporary car insurance from Tempcover can offer cover for.

With short term cover, you’ll get comprehensive cover rather than just third-party only which means that if you have an accident while borrowing a car, their no claims discount is protected. For the same financial protection as an annual policy without the long term contract and the hefty price tag, temporary insurance is the best choice!

The price of all car insurance policies has begun slowly increasing again which means it’s now more important than ever that you don’t just settle for the price you’ve paid before

Now while temporary insurance can be the cheapest option for you, there are ways to save even more money and that’s by making sure you have the best deal possible.

Buying temporary insurance is like buying anything else, the best way to save money is to compare prices and find the best deal for you.

Tempcover is UK’s largest provider of temporary and short term car insurance and that’s because we work with some of the biggest insurance providers to ensure you get the best deal possible. While other temporary insurance providers simply offer you one quote, Tempcover is able to offer a wide range of quotes depending on your circumstances.

With multiple quotes and the ability to select the duration of your policy, you get the cheapest priced temporary car insurance without having to spend time searching online.

Before you even get a quote, you can reduce the cost of your policy by reducing the risk you pose. While there many factors that make up the price you pay for your premium, the six main risks according to the ABI (Association of British Insurers) are the following:§

There are some factors which you obviously can’t change and lying to alter your age or address would be considered fraud.

Famously, the way you describe your job can have an impact on how much you pay. Something as simple as changing your job title from an office manager to and office administrator could save you money.

Also, think about the type of vehicle you’re borrowing. Of course, you more than likely limited to what vehicles you have access to, if you do have more than one option, you should try and use a car that’s safer, slower and less eye-catching.

While you may not look as hot cruising down the streets, your bank account will thank you. Fast and flashy cars are more likely to be in accidents and attract the attention of vandals and thieves.

By increasing the amount you’re willing to pay if you have an accident, it’s likely the price of your premium will drop. This is a great way to reduce the cost of your overall premium but you should never agree to pay an excess that you can’t afford.

Remember that along with your voluntary excess which you can adjust depending on how much you’re willing to pay, you also have your compulsory excess. If your compulsory excess was £500 and you increased your voluntary excess to £300 to reduce the overall cost of your premium, you would be agreeing to pay £800 in total towards any repairs.

While you should never have a total excess more than you can realistically afford to pay out if you can afford to pay more if you have an accident then increasing your excess could bring the price of your premium down.

Probably the most frequently asked question when talking about car insurance is why it costs so much. For most drivers but especially younger drivers, the cost of insurance can be a pretty sizeable expense. When you consider that in the last ten years, car insurance prices have risen by over 50%, it’s understandable that motorists are frustrated.

While it may appear that not much has changed to warrant the continued price increases, there are many reasons why the cost of annual insurance is on the rise.

The biggest cause of increasing prices is the simply the massive costs that come with insurance claims. In the UK there is no limit to the amount that insurance providers have to pay out to third parties; this means that they are forced to pay out millions of pounds in claims.

In order to recoup this money, they will spread the cost across the board, increasing everyone’s premiums by a small amount.

Unfortunately, the behaviour of unsafe drivers across the country can have an impact on the price of all our premiums.

Other factors including fraudulent insurance claims and having to cover the costs of uninsured drivers can cost insurers millions of pounds each week and unfortunately, these costs get passed straight on to the motorists.

The frustrating part of insurance, especially for your car is that you’re paying for something you hope you never need. Paying out every month or every year can be frustrating when you don’t have something you can hold or use.

The thing to bear in mind when thinking about the cost of insurance is, not only do you legally have to have car insurance but the amount of financial cover you actually receive is huge. Without insurance, you would be forced to pay out hundreds of thousands of pounds if you caused an accident.

This peace of mind lets you focus on your life and your job without the stress of worrying about being in an accident. Insurance should not simply be seen as just a requirement but as a form of protection from any future mistakes you make or misfortunes you may have.

The only way to truly reduce the overall cost of car insurance in the UK is if all drivers were safer on the roads and if those looking to get a quick payout from insurers stopped trying to cheat the system.

Until that happens, the only way to reduce the cost of your cover is to lower the risk you pose and find the right policy for your situation.

A temporary policy is naturally a lot less expensive than having to pay out for an annual policy but many people are under the impression that a one day policy, for example, should cost the equivalent of one day’s worth of an annual policy. If that was the case, taking the average car insurance policy of £767†, one day’s worth of cover would only cost £2.10.

You can understand why temporary insurance costs a little bit more than that when you look at what you get with a short term policy.

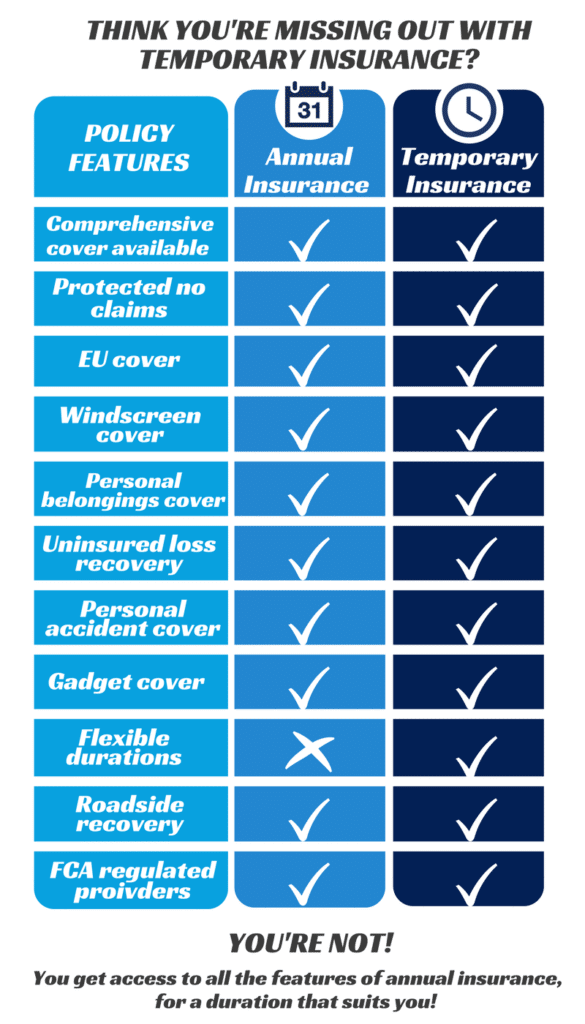

You’re never missing out with temporary cover as it offers you all the same features as yearly cover and in some even more. You pay less overall without missing out on anything.

Alongside all of that, you get the comfort of knowing that if the worst should happen you have thousands of pounds worth of protection behind you.

Although temporary cover is slightly more expensive than you may initially think, not only is it cheaper than annual insurance, it’s often less expensive than adjusting an existing policy and the increase in premiums that come as a result.

The price you pay for temporary cover depends entirely on the information you provide during the quote process and how long you want the policy to last.

Finding cheap temporary car insurance is quick and easy with Tempcover and it’s perfect for a wide range of everyday situations.

To find out more about temporary car insurance and how it could help you, check out one of our handy guide pages.

Sources

† https://www.confused.com/car-insurance/price-index

§ https://www.abi.org.uk/Insurance-and-savings/Products/Motor-insurance

We also currently hold an ‘Excellent’ rating on Trustpilot with over 30,000 reveiws.

After you’ve bought your policy, your documents will be emailed to you instantly so there’s no waiting around.

We use essential cookies to make our website work. We'd also like to use non-essential cookies to help us improve our website by collecting and analysing information on how you use our website and for advertising purposes.

You can agree to accept all cookies by clicking 'Accept all cookies' or you can change your preferences by clicking 'Manage Cookies' below. For more information about the cookies we use, see our cookies policy

We use essential cookies which are necessary to ensure our website works correctly.

We'd like to set non-essential analytics and marketing cookies that help us provide a better experience to our users. These help us improve our website and marketing by collecting and reporting information on the campaigns and web pages you interact with. It also helps us to target our marketing campaigns to people who are most likely to be interested in our services.

We'd also like to set a non-essential cookie which enables us to playback your journey on our website to assist with troubleshooting and to help us improve our website based on the behaviour of our customers.